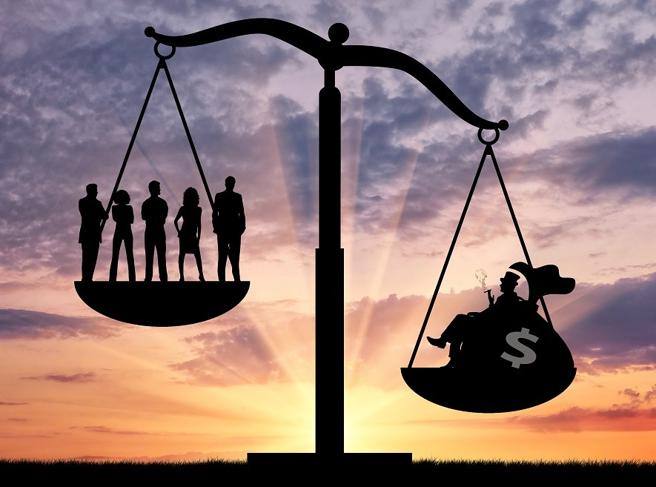

In 2022, in Europe, the top 1% of the population held an average of 11.4% of the national income, but in Italy, this percentage, already concerning in itself, rises to 13.6%. Looking at the bigger picture, the situation does not change: Italy, as highlighted in a report by Openpolis, is among the main EU countries that has experienced the most marked concentration of wealth: +7.4% between 1980 and 2022.

This is a growing wealth gap that has been widening for decades due to historical, structural, economic, and social factors. It requires equally deep interventions and political investments that look into the distant future.

The common thread that unites Italy from north to south is tax evasion, which amplifies the income gap. Therefore, alongside structural factors, there is the inefficiency of the tax system that favors tax avoidance and its degenerations.

While tax evasion may be a small part of the problem (although it still costs the state treasury 84 billion), it is immediately attackable, whereas it takes generations or decades to trigger organic changes. A more efficient tax (and regulatory) system would also have the merit of unmasking the real “bad guys” who are not the wealthy who pay taxes (and if they become wealthier, they will pay more taxes) but those who hire a tax advisor to find the most convenient “paradise” and at times hide so shamefully that they end up in the “poor” category.

At least this is where we should start. And then begin the more difficult journey that intersects with economic growth and a fairer income distribution.

But it requires a long-term view and does not bring immediate dividends, i.e., votes. 5 February 2024 (modified on 5 February 2024 | 18:58)

© ALL RIGHTS RESERVED