3 February – 14:03

© RESERVED REPRODUCTION

You can browse with a maximum of 3 devices or browsers. To continue browsing, you must log out of another session.

On mobile, you can browse with a maximum of 2 devices or browsers. To continue browsing, you must log out of another session.

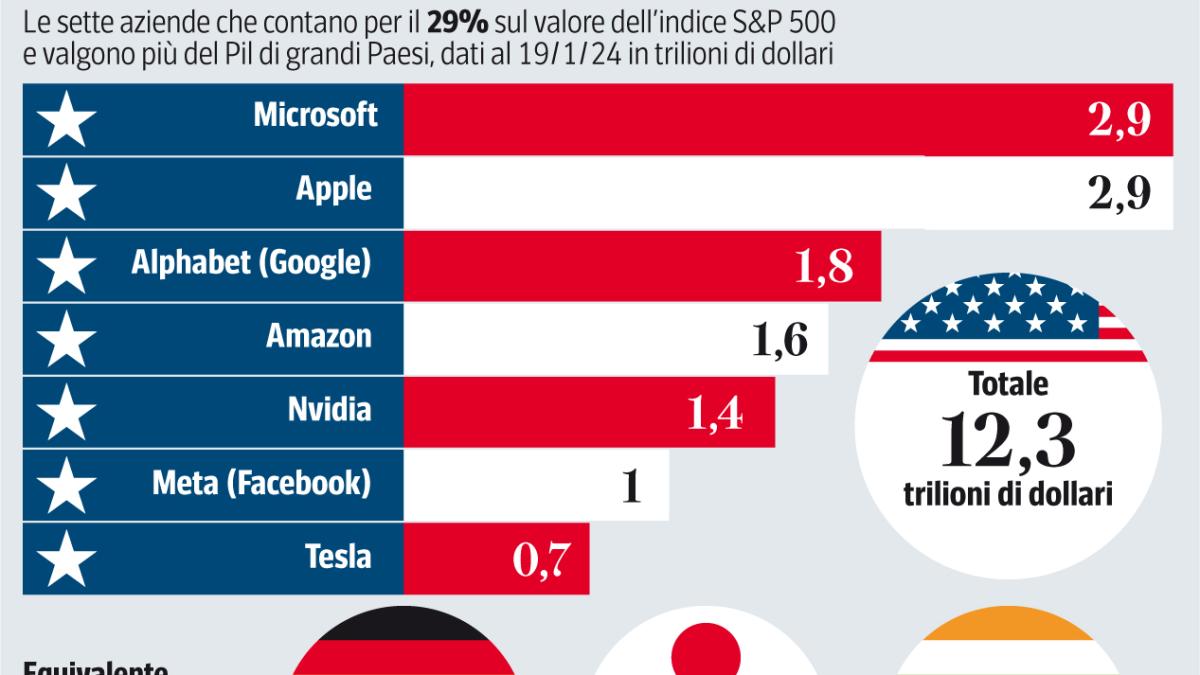

They are worth 12.3 trillion, more than the GDP of Germany, Japan, and India combined. They have driven the S&P500 up by 65% while the other 493 companies have grown by just 20%.

Now analysts have doubts about their sustainability. The Magnificent Seven are back in action, pulling the entire Wall Street Stock Exchange.

They are the leaders of the S&P500 stock index (in alphabetical order): Alphabet, the parent company of Google, Amazon.com, Apple, Meta, the parent company of Facebook, Microsoft, Nvidia, and Tesla. Thanks to them, the S&P500 has reached new highs in recent days.

Since the lows of October 12, 2022, the Magnificent Seven have appreciated by 65%, almost double the 35% performance of the entire index and much more than the 25% of the remaining 493 companies comprising the same index. Thanks to their size – ranging from Apple and Microsoft’s $2.9 trillion to Tesla’s “mere” $700 billion – the Magnificent Seven account for almost a third (28%) of the entire S&P500 index.

If it were only calculated on the arithmetic average of stock prices – as is the Dow Jones – it would show a less brilliant performance. If only a few stocks are driving up the S&P500 index, while the majority are declining, it can be a cause for concern.

But in recent months, an increasing number of listed companies have joined the rally: over half of the 500 now have prices higher than those reached in the previous Wall Street peak in January 2022. In 2023 alone, the seven leading stocks have added 5 trillion (5 trillion) dollars to their market value, doubling it.